If this is the future of challenger finance, maybe it really is time for crypto. Starling Bank

A walk-through of the frustrations of operating with modern finance operations like Starling Bank. To be clear - it will never be time for crypto…

I have blogged in the past at the frustrations of trying to deal with large organisations. Several years ago, I was moaning about how much I hate ’no-reply’ from addresses in comms with BA as the example. And before that, I talked about what happens when you let your systems run your comms, like TripAdvisor does.

But the grand-daddy of annoying organisations to try and engage with are the monolithic finance institutions. Your average high street bank has barely ever had to give a shit that they’re a generally a nightmare to deal with because for the mostpart your average joe punter has had no choice. If you wanted a bank account, you had to pick one at random and then just hope they didn’t lose all your money. If you were lucky, you’d get a free model Griffin1. If you were unlucky you’d get a plastic pink pig2.

Change a-cometh

This has been changing, and it’s been changing for a lot longer than you might think. Before people started calling fintech fintech, in fact waaaay before, things were starting to change. All the way back in 1989, First Direct was launched as an offshoot of Midland Bank, that introduced fully branchless banking. Even Paypal has been around for a somewhat unbelievable 24 years.

Challenger banks

Challenger banks started to become more of a thing following the full-on meltdown of international finance in the late 00s. These organisations where springing up to try and dissolve some of the power that main players all had and spread the risk out a bit. The appeal was that these orgs could be small and nimble, agile, even - to provide a better customer experience and use technology to be more efficient. Metro Bank was one of the first - receiving its license in 2010, and since then plenty more banking licenses have been issued. The key here though is that they’re still banking institutions - which means they’re regulated entities, they are protected by certain consumer laws, and they can’t just dick about with your money - but they can nevertheless challenge the norm and pressurise those around them to do better.

And that sounds like a jolly good thing indeed.

It’s all good until it’s not

So why on earth am I wasting precious time and effort espousing the bleeding obvious benefits of this new modern way of doing things? Surely it’s far more amusing to rag on the crypto-bros and the NFT-crazies?

Well yeah, it’s all good until it’s not. We have a small business venture which has got to the point where having a dedicated bank account - a business bank account, even - would make things simpler. In fact, necessary, because nowadays the account name checking stuff is very confusing when the name that someone is paying is not the name of the business they’re expecting.

I -reluctantly- went in to one of the local High Street banks (whom I already have accounts with) and asked what was required. In a bizarre turn of events, the person I spoke to, looked around, almost furtively, looked back and basically whispered

“You should open up with Starling Bank. It’s what my partner uses for their small business. Trust me, it’ll be easier.”

Weird, I thought, but actually pleased nonetheless to get some straight-forward advice for a change, and unfamiliar with Starling, did some Googling about. And yep - they actually advertise a sole trader bank account - this would be absolutely ideal. Applying for the account is very simple also - you need a smartphone, download the smartphone app and then begin the process. You answer the usual range of questions that you might ordinarily expect - name, date of birth, full postal address, nature of the business and so on. Pretty standard due diligence stuff.

The app prompts you to provide your identification - and you can photograph your driving license or passport right there. You upload a PDF of some historic bank transactions. All good - they’ve got AML responsibilities - I get it.

It was all done in around 30 minutes and I was promised an answer very soon. It’s all very peppy, a read through of their website ticks all the usable ‘fun, friendly, and approachable’ stuffs to make us feel all warm and fuzzy.

I mean, the application process actually apologises to you - that it may take a little while to get back to me - but this is because there are no robots here, this is real humans doing real human stuff to assess my application. No automated decision making here.

Wow. This is all looking good; getting better, look at these claims:

- Always open - day or night open 24/7 to lend a hand

- Always fast - save time with responses in the app

- Always human - speak to real UK-based humans

- Always free - all service is priority service at Starling

Very excite.

And then it began

The first response we got from the application process was that they needed the identification again. This was a message that looked very automated. It might actually have been created by a human, I suppose, but it was definitely a copy/paste job out of the playbook. No explanation as to why it was needed again - just a regurgitation of the previous directions on how to do it. So we provided another copy of it, right there in the app, not thinking much of it.

That was until a day later when we got another very automated looking message - this time via text, with information on our application. It directed us to the app, where we were told that they would not open an account. That was it, nothing else. Just - computer says no.

The app then refused to do anything else. There was now just one screen and it just did nothing like it had deactivated itself, Terminator style.

Confused, I emailed them asking if they could elaborate? Provide something?

Guernsey

You see, my suspicion is they turned it down was because we’re in Guernsey.

I mean, I had been recommended to open the account by someone in Guernsey because they knew someone using it here in Guernsey.

I MEAN the application process literally takes my address (based on postcode lookup) and could verify at that point whether the address was valid (or not).

But… Guernsey is a regulated territory that is not a part of the UK. Monzo and Revolut used to operate here but do not anymore for this reason. It is more than likely that Starling Bank simply aren’t allowed to offer deposit services here, as they would need a license from the local regulator, not the UK one.

Other than the inconvenience, and the fact they should prevent the application much sooner, this would be a perfectly reasonable response from them. To the extent that I asked them - repeatedly - whether they had declined the application because we’re in Guernsey. It was a fairly simple question.

If they would have just told me why not, I would have been OK with it - whether because of the Guernsey address or something else. Something, anything - some semblance of why they computer said no.

But no, I got trapped in a customer service loop that only served to yield more frustration. The emails were invariably answered by different people, and invariably repeating the same shpiel that had already been regurgitated. But for an organisation so seemingly intune with their customers, their needs and what it means to provide a great service, here are some quotes from their correspondence:

Thanks for getting in touch with us and please accept our apologies for the delay in getting back to you.

I am sorry to hear that your application was declined. We would of course love to have you on board as a customer with us but sometimes we are unfortunately not able to offer accounts to everyone for a variety of reasons.

As this is a business account application I will get in touch with the business team directly and ask them to send you an email with information and feedback regarding this application being declined.

OK, reasonable start.

Thank you for your business banking application.

We have carefully considered the information you have provided to us and we are unable to offer banking services to your business.

We understand that this is not the outcome you were hoping for, however this is our final decision.

Unfortunately we cannot elaborate further as to how we have come to this decision.

We would like to thank you again for your interest in Starling Bank, and we wish you and your business all the best for the future.

Ah. It’s nice they can empathise buuutt… whatever.

I asked why they would not be able to elaborate:

Why can you not elaborate further? Can you at least answer my question as to whether you are able (in theory) at least to provide to residents in Guernsey?

And…

In line with company policy, the Business team do not have to elaborate on application outcomes.

So here we have it. Company policy. That is indeed ‘unfortunate’. I begin to get more frustrated:

Unsurprisingly, I wanted to know why the application had been rejected. The sole trader bank account is advertised as being exactly in line with the business we want to use it for. I provided all due diligence / KYC documents as requested and we have no credit issues.

As I have said repeatedly, my suspicion is because my address is Guernsey and you are likely not licensed to provide accounts here but I simply wanted that to be confirmed. I’m not sure why this is so difficult.

A ‘company policy’ of not telling your customers what is going on is… pretty daft. “Computer says no and our decision is final” is reminiscent of the large organisations you’re supposed to be replacing.

Are you able or willing to provide any additional information about why the application was rejected?

To which their response…

I have checked in with the Business team and unfortunately they will not be able to elaborate any further on the application decision.

So that’s it, no dice. No engagement. No effort to provide anything which would help the scenario.

(Although they did tell me they take all feedback very seriously and would be using that to make their service better.)

Well I say that’s it….

But that’s not it at all

At this point, I have no account and no sensible answer as to why not, but I have provided them with a lot of my data, a copy of my identification as well as banking transactions from another bank. This is all information that right now, they have absolutely no use for. So I ask them, reasonably:

Please confirm that all of the information that was submitted as part of the application has been permanently and irretrievably deleted from your systems (as per my rights under aspects of the GDPR.)

A full week later and I’ve heard nothing so I chase them, to which they finally responded:

Please accept our apologies for the short delay in returning to you.

Even though we did not fully complete the account opening process, as a bank we are required to keep a record of all account applications where we go beyond a certain stage and in particular where we have initiated checks with a credit bureau.

We are required to keep these for 6 years.

Therefore unfortunately at this stage, we cannot comply with your request completely.

I asked them which regulatory requirement they were being forced to comply with:

In line with the Information Commissioner’s Office guidance, the right to erasure doesn’t apply if processing is necessary to comply with a legal obligation.

As a bank we are required to comply with a number of regulations including General Data Protection Regulation and The Money Laundering Regulation 2017.

Under regulation 40 of the Money Laundering Regulations 2017 Starling must keep a copy of the documents and information obtained to fulfil our Customer Due Diligence obligations.

to which I replied:

The AML regulations require CDD documents to be kept in some situations for five years (not six as per below quote) however I am still looking for the explicit or prescriptive regulation or legal obligation as per your previous statement (emphasis added):

“as a bank we are required to keep a record of all account applications where we go beyond a certain stage and in particular where we have initiated checks with a credit bureau. We are required to keep these for 6 years.”

to which they just referred me again to their privacy policy and effectively refused to answer the question.

At which point I did exactly as they hoped I’d do - realised I was not going to get anywhere, not going to get anything like a human answer that wasn’t just reading from the same dog-eared playbook. I gave up.

Let’s be really clear

Starling Bank’s decision to

- (a) not tell me why they refused the application, and

- (b) why they refused to delete my data

is entirely a Starling Bank corporate policy and absolutely nothing to do with any regulation. In fact, probably the only regulation here is that they couldn’t provide the account because they’re not licensed to do so in Guernsey. Possibly.

This is my guess, but it’s entirely feasible that they have refused the application for other reasons, and I wouldn’t be surprised if it’s because the business we proposed would not be lucrative enough for them. They are a bank like any other and they’re in business to make money. Just look at their ownership - a billionaire at the top and a bunch of funds as majority owners / investors.

Its investors include some of the world’s biggest financial heavyweights. They are:

JTC, which oversees the investment activity of Harry McPike, a global private investor; Jupiter (formerly Merian), a leading investor in the UK; Fidelity Management & Research Company, a global investor; RPMI Railpen, the investment manager for the £31 billion Railways Pension Scheme; Qatar Investment Authority, the sovereign wealth fund of the State of Qatar; Millennium Management, a global investment firm; and Goldman Sachs Growth Equity, part of Goldman Sachs Group.

What’s the likelihood that they declined the business because it didn’t provide enough opportunity to make cash out of us?

I don’t know. Because they refuse to say anything about their decision making process.

They could tell me if any of this if they wanted to. But they are choosing not to.

Net result: we collectively wasted a good three weeks’ time going round in circles just trying to get through to one another. I dread to think what the culture must be like in the customer service team there.

Why

This is infuriating for several reasons.

-

This is not just sour grapes due to them not opening the account. It’s sour grapes because they are just mindlessly repeating all the same mistakes that the very organisations they’re supposed to be replacing make. They have every opportunity to do better, and they refuse.

-

If it’s an address thing; their application process should identify it.

-

If the refusal was due to something else - they should tell me what. They have no regulatory duty not to - nor are they obliged to, of course - but this is simply a corporate policy that does not need to exist.

-

They have no need to keep my information; it would be reasonable to delete it. Neither the ICO nor the FCA would expect them to keep my information for this process. They are the ones choosing to keep it.

Perhaps not the only one

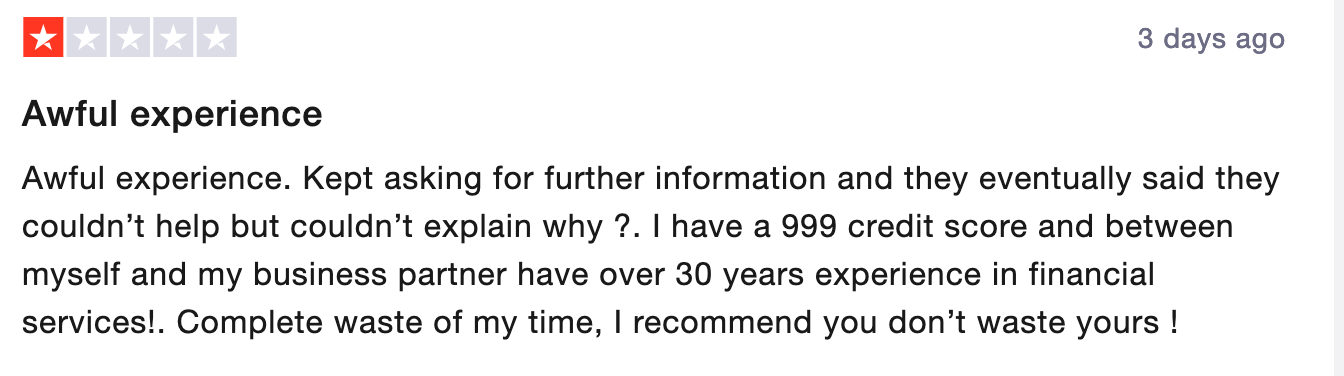

Starling Bank go to great lengths to show all the positive reviews they receive on TrustPilot.

But you’ll be surprised to learn there was absolutely nothing refreshing about this experience. It just felt like the same mouldy experience you get from every other institution.

And it seems I’m not alone on this as on TrustPilot more than 10% of the reviews are ‘bad’ and this experience sounds pretty familar…

So it seems there is nothing extraordinary about my experience and I doubt very much that anything is going to change anytime soon. So in the meantime, Starling Bank…

-

Natwest ↩︎

Posts in this Series

- Sorry not sorry Audible.

- OK Google, you win. Also - fuck you.

- So close, yet ultimately... so far: Ikea.

- In hindsight, Nespresso, you did OK

- Garmin - really doesn't care.

- eBay - apology please. I'll wait. Maybe.

- Algorithms Are Shit - Carvana, Amazon

- What is this approach to marketing? Blinds Direct

- If this is the future of challenger finance, maybe it really is time for crypto. Starling Bank

- Why I hate no-reply / unmonitored inboxes: British Airways

- Dear TripAdvisor, your systems have gone rogue